News

Nordic and UK pension funds commit US$130 billion in climate investments by 2030

At COP26 in Glasgow, a collective financial commitment of US$130 billion was announced by CEOs of Nordic and UK pension funds, to be invested in clean energy and climate investments by 2030.

The asset owners from the UK, Sweden, Norway, Finland, Denmark, and Iceland made the commitment in an aim to contribute to increasing global climate ambition and spur the global uptake of climate investments for the green transition by 2030. In addition, a pension fund from Greenland has declared its support.

The move builds on a 2019 commitment by Danish pension funds to invest $55 billion in the green transition by 2030:

“Green transition requires massive investments. Governments have to do their part and commit to a new green future. But we also need private investors on board. In 2019, Danish pension funds committed to invest 55 billion dollars in the green transition by 2030. I am proud that we have inspired others and that Nordic and UK pension funds are now ready to invest 130 billion dollars in total by 2030,” said the Danish Prime Minister Mette Frederiksen during the announcement.

Related news: The Danish government and the Danish pension industry announce investments worth billions in the green transition

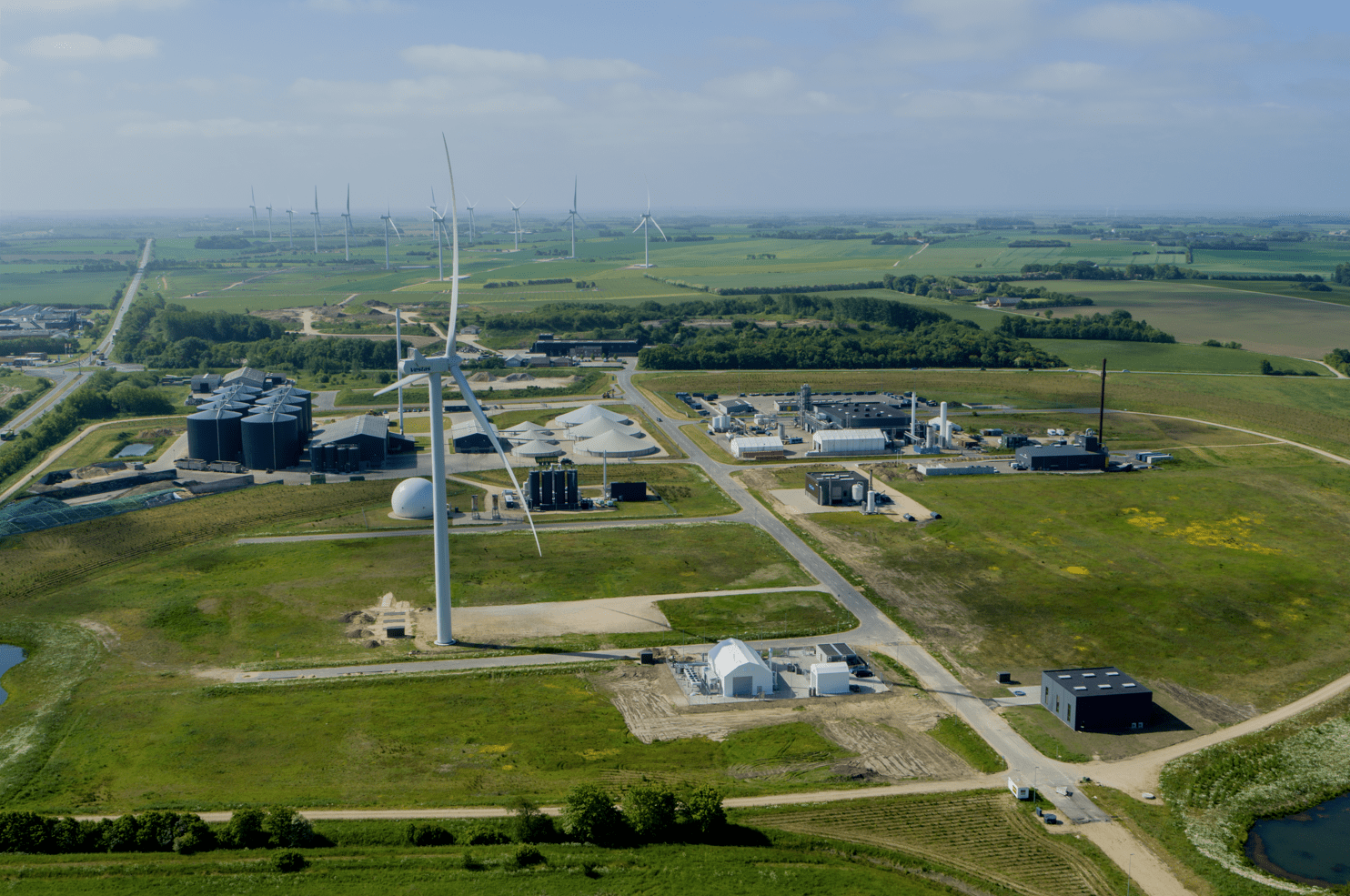

The commitments comprise investments in listed and unlisted equity investments, green energy infrastructure in the OECD and emerging markets, green bonds and debt, climate-friendly investments in properties, among others. Working directly with institutional investors to ensure that commitments are being implemented, tracked, and reported on, the international public-private sector initiative, the Climate Investment Coalition, warmly welcomed the new commitments:

"These ambitious pension funds are taking critical steps to ensure pensions take advantage of the enormous opportunities of the green transition, help spur immediate solutions to lower carbon emissions, while protecting our savings against the ravages of climate change. As we look ahead beyond COP26, we aim to grow these financial commitments, raising investor ambition to create a far-reaching impact by 2030,” said Co-Chair Peter Damgaard Jensen.

The Climate Investment Coalition aims to create an international wave of climate investments to support meeting global goals for climate and sustainable development. The Coalition has been established by the Government of Denmark, Insurance & Pension Denmark, the Institutional Investors Group on Climate Change (IIGCC) and World Climate Foundation as the leading global public-private partnership mobilising ambitious financial investments towards clean energy and climate solutions now and in the coming decade.

You should consider reading

events

Carbon capture, storage and utilisation

+4