Key take-aways

Explore the role of the financial sector in incentivising a green transition

Learn about how partnerships can act as a means to accelerate the green transition

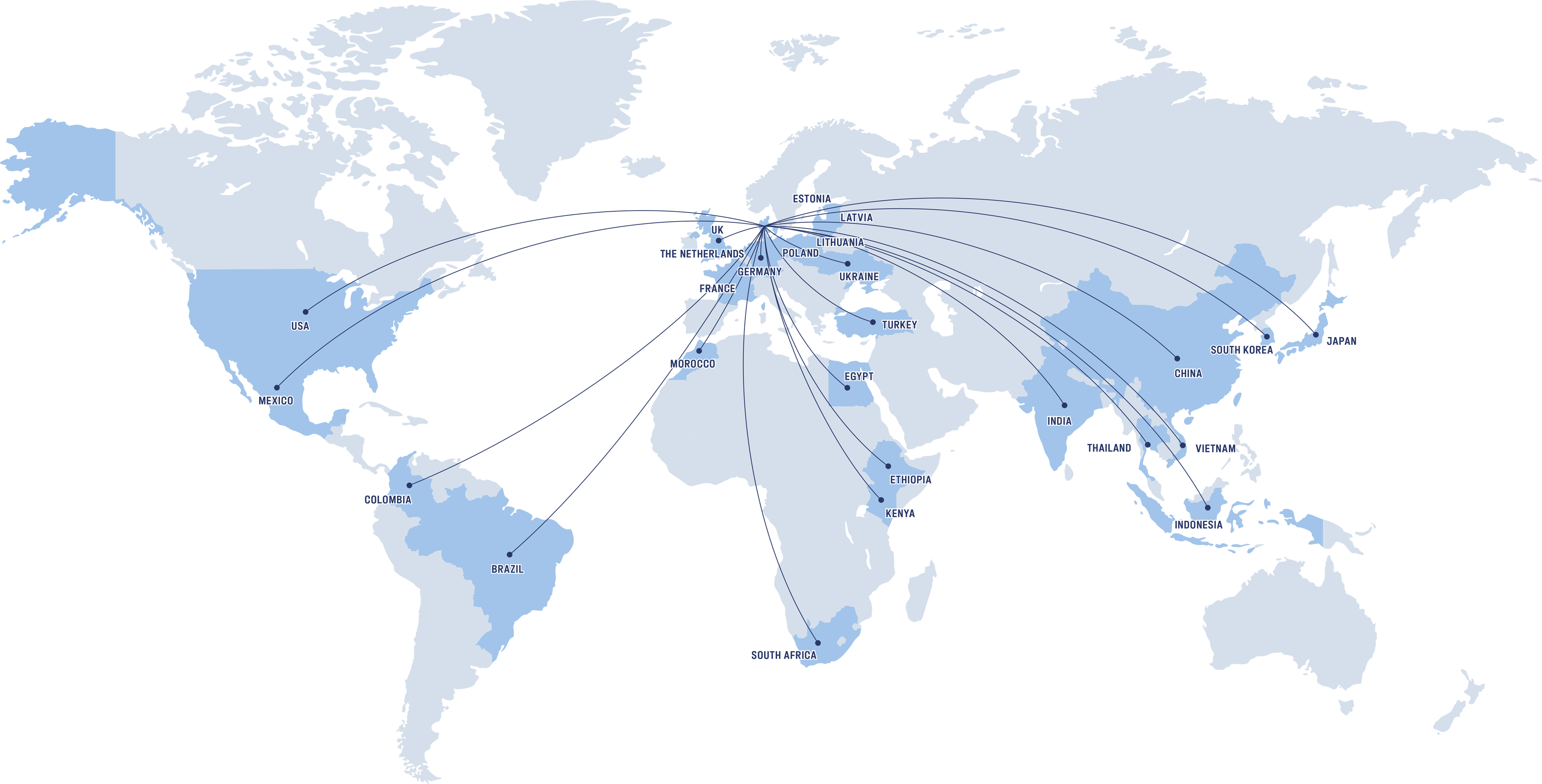

Understand Denmark’s position as a driver in mobilising private investments

Explore public-private partnerships and tangible solutions to financing the green transition