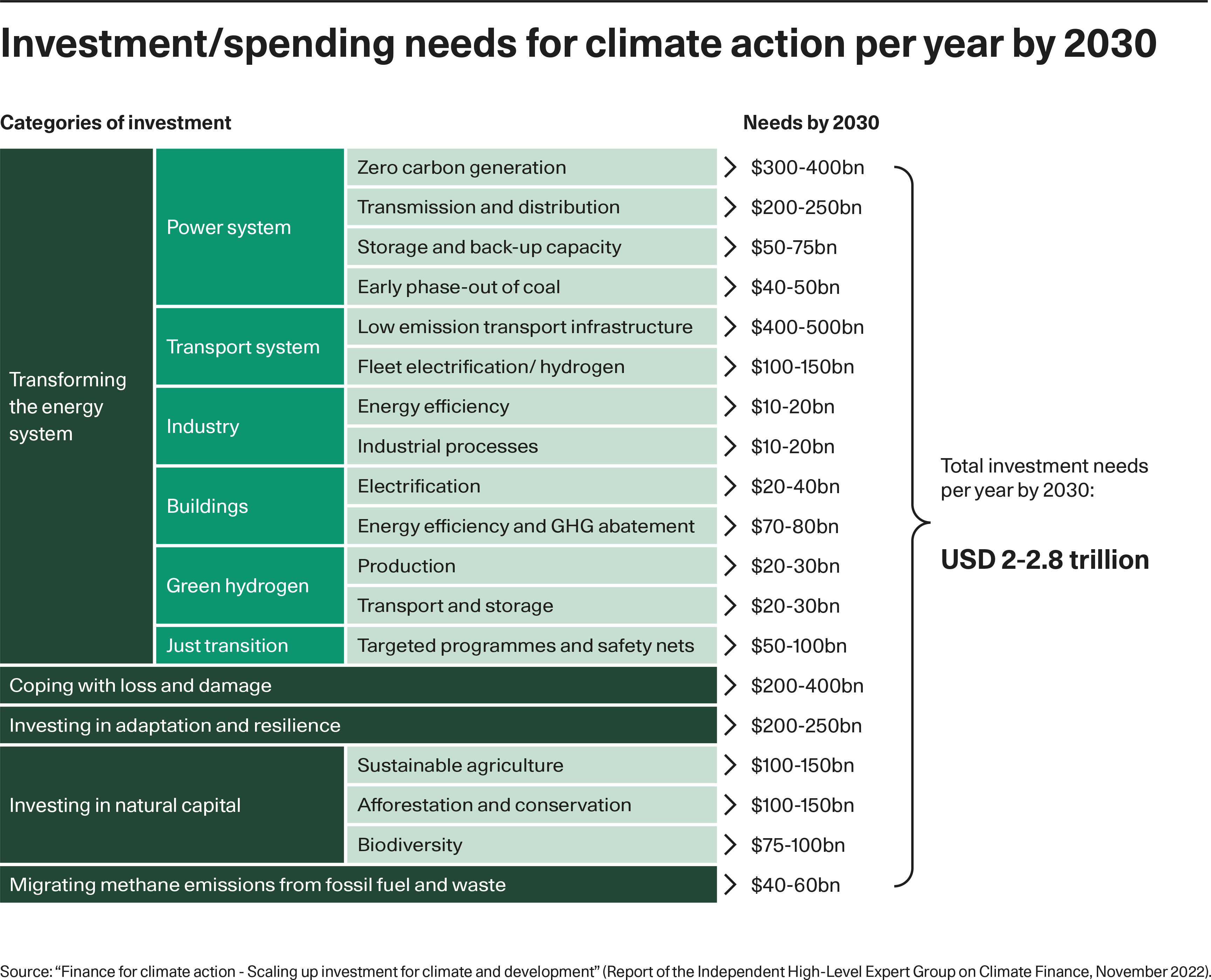

The world urgently needs to transform energy systems, reduce CO2 emissions, conserve natural resources, increase biodiversity, and increase climate resilience through adaptation measures in a socially just manner. Both the Paris Agreement and the Kunming-Montreal Global Biodiversity Framework (GBF) have set ambitious targets to drive this action. It is estimated that global investments required to achieve the targets set out in the Paris Agreement will range between EUR 2.9-5.7 trillion (USD 3-6 trillion) per year until 2050, and at least EUR 190 billion (USD 200 billion) annually towards 2030 to reach the targets in GBF. While the financial sector itself has a small direct carbon footprint, it plays a key role in transforming economies and mobilising finance to reach these critical targets.

In the past decade, both public and private sector have mobilised large climate financing schemes and established initiatives such as Glasgow Financial Alliance for Net Zero, Net-Zero Banking Alliance, Net-Zero Asset Owner Alliance and Climate Investment Coalition. Public-private collaboration is essential to de-risk large investments in the green transition and provide political framework conditions to ensure that sustainability means business.

Investment needs

To accelerate the global green transition, several investment needs must be addressed. Firstly, countries must transform their energy systems. This requires large investments to scale up new technologies and energy infrastructure systems across developed and emerging markets. Investment here is required to ensure sustainable sourcing of critical materials to electrify energy systems, improve energy efficiency in buildings, decarbonise hard-to-abate sectors and mature technologies like Power-to-X, ensure greener transportation, and create green shipping corridors. Secondly, there is a growing need for investments in critical infrastructure to face increasingly frequent extreme weather events, from climate adaptation measures to finance for nature-based solutions. Lastly, investing in nature conservation and biodiversity to safeguard continued absorption of CO2 emissions through carbon sinks, like rainforests and oceans, is also critical.

Systemic needs

While the financial sector overall seems to recognise the need for climate finance, there are some systemic issues that must be addressed to scale it. These include making it more attractive to make sustainable finance choices and ensuring investments made today are profitable in the longterm. International organisations and institutions need to create a common language and standards to define sustainable investment and create a global level playing field with stable and predictable framework conditions that reflect the climate risks related to investments. An important steppingstone to do so, is the legislation and regulation introduced by the European Union, like the EU Taxonomy and CRSD, where companies and financial institutions must report on their activities’ impact on GHG emissions. However, a global common language and standardisation would ensure that everyone works under the same framework conditions across the world.