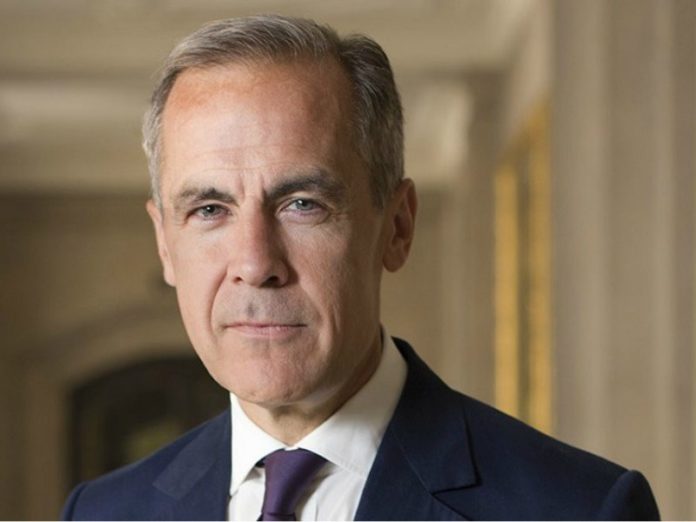

Foreword by

Mark Carney, UN Special Envoy on Climate Action and Finance.

Explore the white paperPerspective

Green financing

For the world to avoid the worst impacts of climate change, we need a transformation of the global economy and energy systems on the scale of the industrial revolution, but at the pace of the digital revolution. Every public and private entity, from national governments to local businesses, must begin implementing credible plans for transitioning to a low-carbon, climate-resilient future. We have no time to spare, and the stakes are high. The latest estimates are that the world’s remaining carbon budget to limit the temperature rise to 1.5°C will be exhausted by the end of this decade.

Higher degrees of warming will impose massive human and economic costs. But there are hopeful signs of progress. Countries representing over 90 percent of global GDP have now made net-zero commitments and are increasingly putting in place the policies to back those commitments. Given the scale of investment required to transition the global economy to net zero, private finance must play a significant role. The IEA estimates that USD 3 trillion of the USD 4.2 trillion annual global clean energy-related investment needed by 2030 must come from the private sector, mobilized by public policies that create incentives, set appropriate regulatory frameworks and send market signals.

There is a growing realisation that addressing climate change is one of the greatest commercial opportunities of our time. As a consequence, finance on the scale required is now in prospect. The Glasgow Financial Alliance for Net Zero (GFANZ) was created in 2021 to expand the number of net zero-committed financial institutions and to establish a forum for addressing sector-wide challenges associated with the transition. Two years later, more than 650 major financial institutions, including many from Denmark, are committing to use their balance sheets, totalling over USD 150 trillion of assets, around 40 percent of global financial assets, to support a net zero transition in line with the Paris Agreement.

Efforts by the Danish asset managers and pension funds highlighted in this report demonstrate the multiplier effect private capital can have in driving the transition forward. Moreover, entrepreneurs, innovators and businesses are increasingly focused on the enormous value that can be created by solving this existential problem. For finance to help unlock climate action it must develop an unrelenting focus on all aspects of the net zero transition.

This ranges from the foundations of climate disclosure, risk management, and transition planning to the development of high-integrity carbon markets and country energy transition platforms to deploy capital beyond developed markets. In this decisive decade of action, Denmark’s leadership is critical to maintaining the pace and scale of transformation the world needs to secure a resilient and sustainable future.