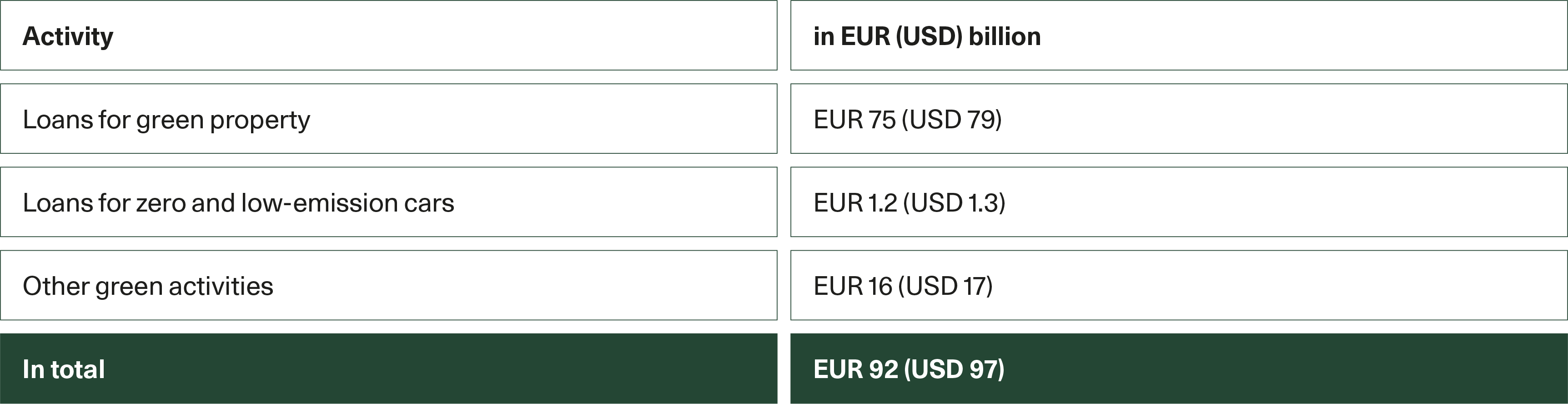

Overview of Danish banks' and mortgage credit institutions' financing of climate-friendly activities

Source: Sustainability Report 2022, Finance Denmark

Perspective

Green financing

The financial sector can serve as an important catalyst to drive the green transition. Daily contact with private customers and companies from all industries gives banks valuable insights into the challenges for both homeowners and companies. They can use this knowledge to design loans and other financial products which make it more attractive for customers to make greener choices, from private customers thinking of purchasing a new car to companies pursuing an ambitious green business transformation. They can also help future-proof their customers’ assets and activities by ensuring they are compliant with current and future regulations affecting them.

In Denmark, banks and mortgage credit institutions have proactively tried to create the best possible framework conditions and incentives to make green and sustainable choices more attractive to their customers. This has included introducing labelling schemes and measurement tools to make it easier to calculate greenhouse gas emissions from financed activities. The financial sector has, for example, jointly developed a model to measure the CO2 footprint of loans and investments. Global standardisation of CO2 measurements is expected to receive increased focus in the coming years, especially with new EU regulations managing the categorisation of sustainable products and sectors.

Also read: Measuring CO2 impact in Denmark’s financial sector

Employee sustainability training in the financial sector is important to ensure that the sector’s ambitions are anchored in day-to-day dialogue with clients. As of 2022, nine out of ten employees in Danish banks had undergone training courses to ensure that they are adequately equipped to consult and advise homeowners and SMEs on sustainability choices. This makes them more competent at developing new financial incentives, such as loan types for customers, as well as at providing customers with better guidance and helping businesses navigate the increasingly complex legislation affecting them.

Banks can contribute to accelerating the green transition by providing access to green loans and financing products with preferential terms for homeowners and SMEs committed to adopting eco-friendly measures. To reach its climate goal of 70 percent CO2 reduction by 2030, Denmark needs more than EUR 11 billion (USD 11.6 billion) to be invested in energy efficiency in buildings. This will require significant up-front investments from developers, housing associations, and private homeowners, but will also lead to savings on their energy bills in the long run. Danish banks have introduced a range of green products giving preferential terms for homeowners and SMEs committed to adopting eco-friendly measures. They have also made a joint effort to inform customers about the environmental benefits, not simply the potential savings, of improving their home’s energy efficiency.

Source: Sustainability Report 2022, Finance Denmark

This article is part of the white paper “Financing the Green Transition”. Discover Denmark’s plans to mobilise investments to accelerate the transition to a carbon-neutral and climate-resilient economy.

Explore the white paper