Sealing funding shortfall

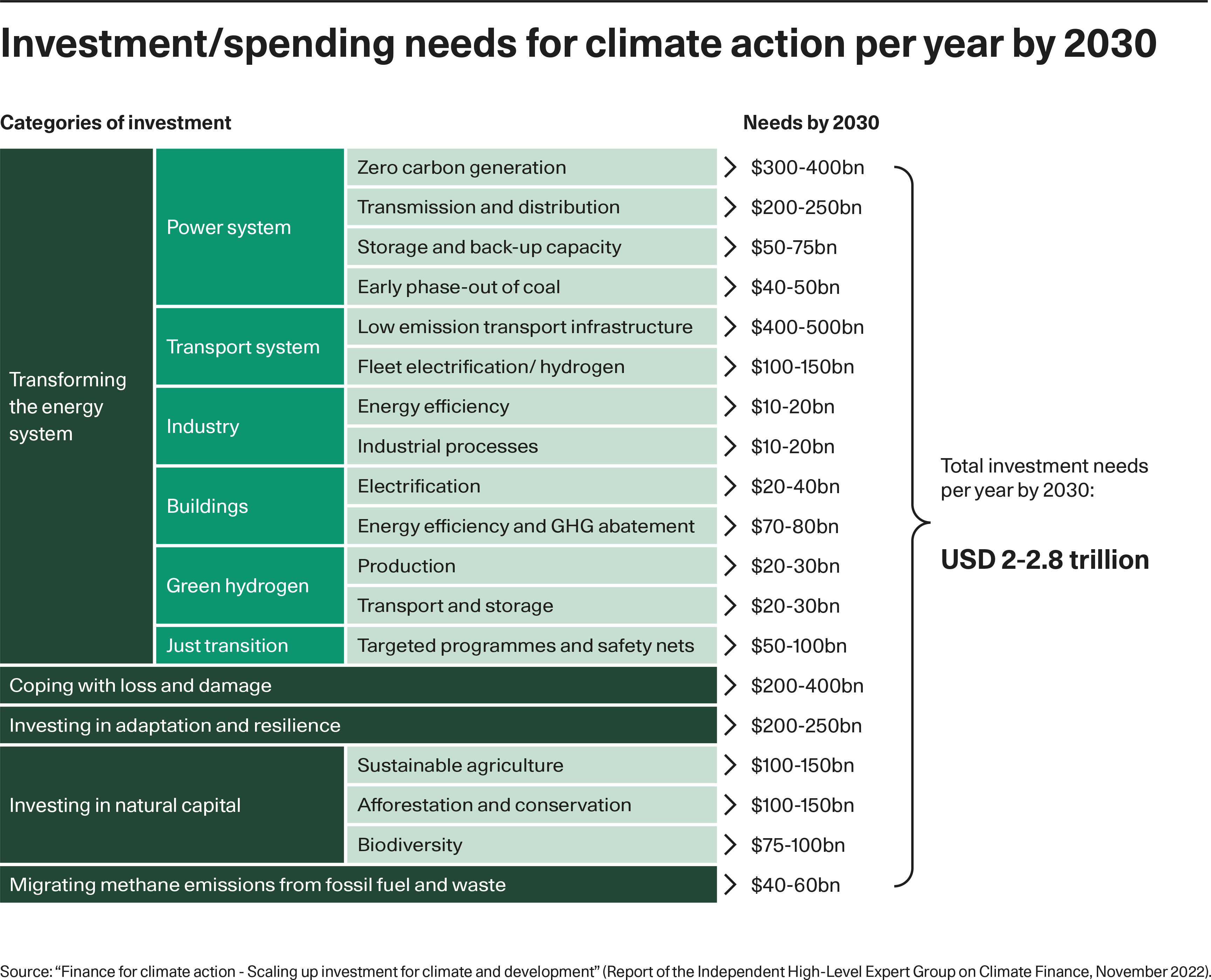

Addressing the investment gap is paramount, especially in times of escalating temperature records, heat waves, floods, droughts, and wildfires. Extreme weather events underscore the urgency, and mobilising substantial financial resources for a globally just and green transition in developing countries presents a global challenge.

The current race extends beyond merely unlocking finance and investments for the green transition. It is equally about ensuring job creation and fostering growth. This becomes increasingly critical given the intensifying global competition to offer companies the most favourable conditions for producing green technologies.

To stay ahead in this race, it is imperative to establish stable and competitive framework conditions. These conditions play a pivotal role in creating attractive hubs for green technology innovation and production, thereby mobilising the necessary finance to sustain these endeavours.

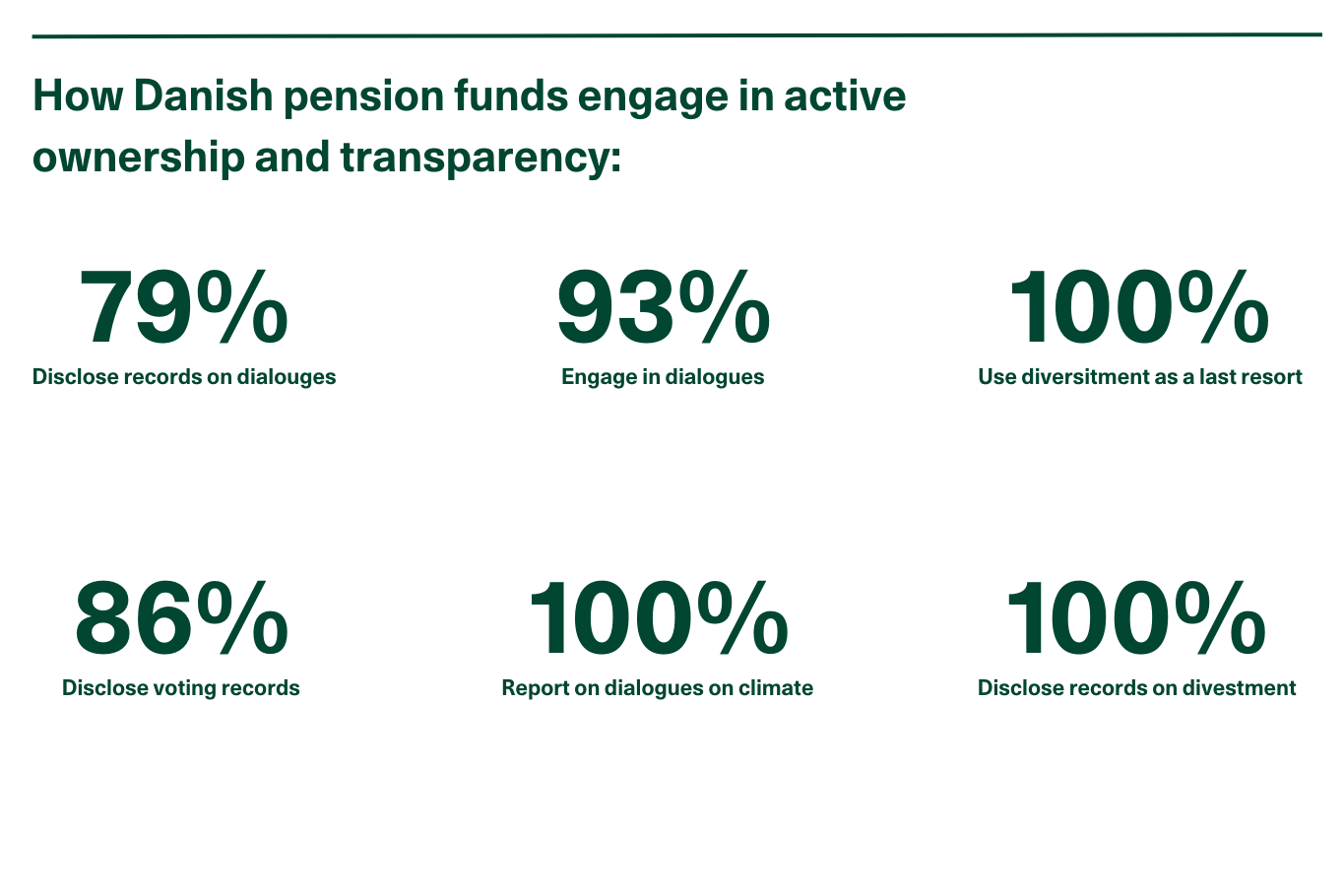

Denmark has extensive experience with financing the green transition, both nationally and internationally. Since the late 1970s, Danish entrepreneurs and innovators as well as changing Danish governments have looked towards developing and promoting green technologies such as renewable energy as well as water and energy efficiency and a move away from fossil energy sources.