Discover the whitepaper: Financing the Green Transition

For a more in-depth understanding of global financing needs and strategies for the green transition, download our comprehensive white paper.

Discover the white paperNews

Green financing

For a more in-depth understanding of global financing needs and strategies for the green transition, download our comprehensive white paper.

Discover the white paperThe sustainable transition is a response to the climate and biodiversity crisis the world faces. Therefore, the transformation of the socio-economy is an imperative task, and the financial sector plays a significant role in accelerating and supporting it.

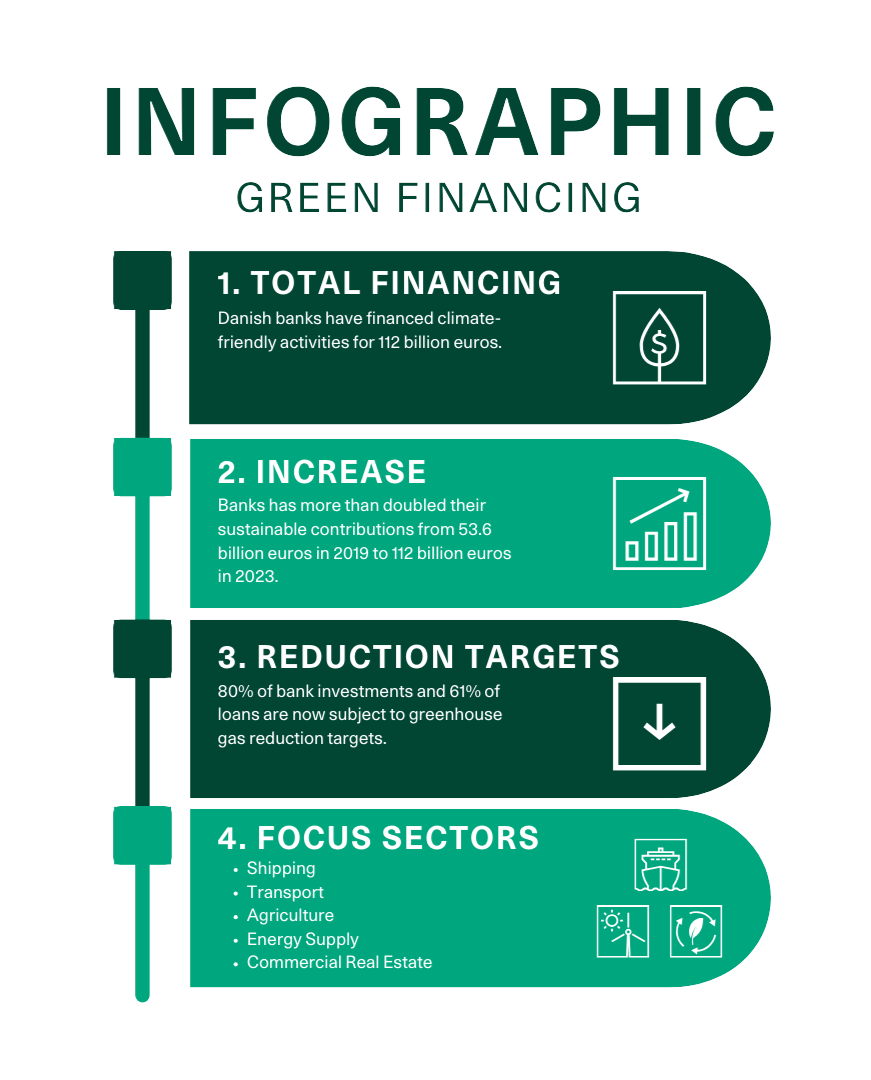

The Danish business association, Finance Denmark‘s sustainability report for 2023 shows that the country’s banks and mortgage institutions have more than doubled their financing of climate-friendly activities since 2019. This increase is due to both the general price development and an intensified sector effort. As a result, the sector has already met its expectations for 2030, by financing climate-friendly activities worth 93.8 billion euros by 2023.

“The financial sector is involved in all parts of the economy, and therefore plays an important role in the transition to a green and sustainable socio-economy. It is a responsibility that we as a sector take seriously and have invested in being able to fulfill. After several years of intensified efforts, the numbers speak for themselves: The contribution of banks and mortgage institutions to the sustainable transition of society has more than doubled from 53.7 billion euros in 2019 to 112 billion kroner in 2023. This is a development we are proud of,” says Ulrik Nødgaard, CEO of Finance Denmark.

The results of this year’s report are based on recent efforts. Amongst other things, the sector has invested in green competency development for almost all employees, has collaborated to develop a CO2-model that is now widely used in the industry, and has supported companies’ transition towards sustainability through active ownership.

Read the full report (in Danish)To curb climate change and accelerate the green transition, finance is pivotal. With pioneering pension funds, asset managers, and public investors, Denmark has long been leading the way in ESG and green financing.

To further accelerate the journey towards a more sustainable future, there is a need for comprehensive transformation among the financial sector’s customers and the companies that banks finance and invest in.

Due to their daily contact with customers, banks and asset managers can support companies and homeowners in making greener choices. Therefore, banks and asset managers have set greenhouse gas reduction targets for large parts of their loans and investments on behalf of customers: 80% of bank investments and 61% of loans are subject to reduction targets for greenhouse gas emissions.

“Even though we as a sector are responsible for a very small part of the total greenhouse gas emissions in Denmark, we have the opportunity and ambition as investors and lenders to contribute to a greener future. With reduction targets for loans and investments, the financial sector is committed to supporting the sustainable transition that their customers will undergo in the coming years,” says Ulrik Nødgaard and continues:

“On the credit side, the initial focus has been on setting reduction targets for corporate customers in sectors such as shipping, transport, agriculture, energy supply, and commercial real estate, where emissions or intensity are highest. However, the expectation is that more and more areas and companies will be included in the reduction targets as banks receive better climate data from companies about their climate impact. The most important thing is that we have taken the first ambitious steps – and this will benefit the entire society!”