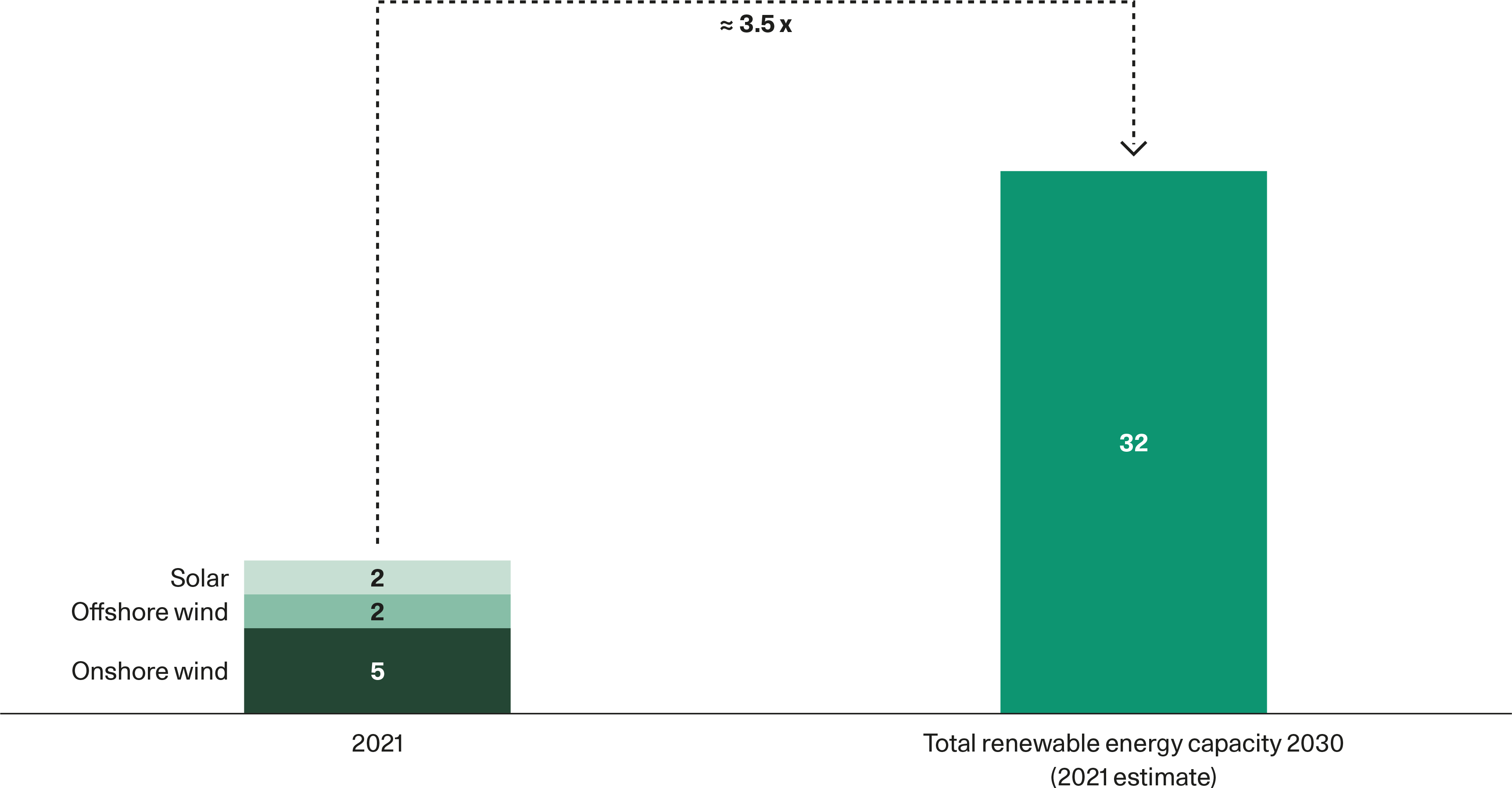

Renewable energy capacity is expected to massively increase towards 2030 (GW)

This figure shows Denmark’s renewable energy capacity in 2021 and the expected capacity in 2030.

Source: The Danish Energy Agency and political agreements of 2021

Perspective

Green financing

Energy systems and markets are changing as renewable energy becomes increasingly more affordable and accessible. In 2022, global investments in energy transition technologies reached a new record of EUR 1.2 trillion (USD 1.3 trillion) . Yet, according to the International Renewable Energy Agency (IRENA), annual investments must surpass EUR 4.7 trillion (USD 5 trillion)to stay aligned with a 1.5°C pathway. The energy transition must address three major pillars: physical infrastructure, policy and regulatory support, and skilled workforce. These necessitate substantial investments and innovative collaboration methods to engage all stakeholders in the transition and address structural barriers hindering progress.

The current rise in inflation and interest rates is expected to impact investments in renewable energy projects. The market price of electricity is expected to become more volatile, as it will increasingly be based on fluctuating power generation from wind and solar. Electrification – and the necessary kick-start to a Power-to-X economy – will largely be driven by policy decisions, which makes the market risk difficult to manage for private investors alone. In this context, it is imperative that global policy makers develop regulatory and financial models where society assumes part of the risk.

Denmark is often considered a global frontrunner in energy systems transformation. Aiming to cut greenhouse gas emissions by 70 percent by 2030 (relative to 1990), the Danish energy and utilities sector has undergone a major transition from fossil fuels to green energy in record time. This has simultaneously reduced emissions, created jobs, and boosted the economy. The change has not been without challenges, including how to best engage with civil society and ensure widespread local support for energy projects. The next steps involve a massive electrification of society, from heating and industry to transportation – either directly or indirectly through Power-to-X technologies. This will require a further scale-up in wind and solar farms onshore and offshore, as well as large-scale energy infrastructure projects like energy islands. It will also require extensive power grid reinforcements and expansions, cross-border interconnectors, and the deployment of new technologies, such as Power-to-X, energy storage, and carbon capture.

Following a political agreement to introduce an ambitious Power-to-X strategy, and government approval of a historic offshore wind agreement covering up to 14 GW offshore wind by 2030, the need for investment in renewable energy will continue to rise as Denmark pursues Net Zero by 2050.

This figure shows Denmark’s renewable energy capacity in 2021 and the expected capacity in 2030.

Source: The Danish Energy Agency and political agreements of 2021

This article is part of the white paper “Financing the Green Transition”. Discover Denmark’s plans to mobilise investments to accelerate the transition to a carbon-neutral and climate-resilient economy.

Explore the white paper