Perspective

Green financing

Transformation through sustainable investments

The Danish insurance and pension industry manages approximately EUR 535 billion (USD 565 billion), which is invested on behalf of Danish insurance and pension customers. It is one of the world’s largest pension assets relative to the country’s GDP, and about two-thirds of it is invested abroad. Members of the Danish Investment Association have assets under management worth almost EUR 600 billion (USD 630 billion) in total. While the primary task of pension funds and asset managers is to generate returns to their customers, both are increasingly working to ensure that their investments are made in a responsible and sustainable manner to mitigate ESG-incurred risks.

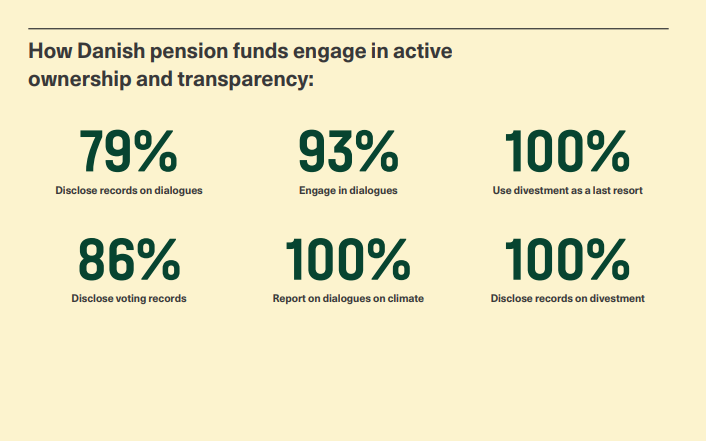

Transparency and responsible investments

Danish pension funds and asset managers have a long tradition of being transparent about their investments. They are recognized for leading the way on how customers’ savings are invested in a responsible manner with respect for human rights, the climate, international conventions, and proper governance structures. Most have published a policy on responsible investment, and all pension funds disclose records of their divestments on their websites. While each institutional investor has a different approach, all Danish pension funds, support one or more international climate initiatives and alliances, such as the Paris Aligned Investment Initiative (PAII), Climate Action 100+, Institutional Investors Group on Climate Change (IIGCC), and the UN-Convened Net Zero Asset Owner Alliance (NZAOA).

Danish institutional investors work with active ownership

The concept of active ownership — whereby an institutional investor uses its co-ownership of a company to influence the behaviour and business strategy of the companies it invests in — is becoming increasingly significant to promote greener choices. Typically, this is leveraged by:

- Engaging in dialogue with management

- Voting at general assembly

- Divestment/exclusion

Danish institutional investors prefer engaging in exhaustive dialogue with companies they invest in as its primary approach to encourage behavioural changes. While divestment is often seen as a last resort where engagement fails, it can ultimately be used to hold companies accountable if their behaviour does not live up to the ESG priorities of the pension funds or asset managers. The institutional investor can also choose to exclude companies without prior dialogue, especially if those companies are subject to international sanctions.

Active ownership as a means to move away from fossil fuels

Pension funds and asset managers pushing fossil fuel companies to transition is a great example of active ownership. Some pension funds propose resolutions at the general assembly of fossil companies and vote to direct these companies away from having an environmentally damaging impact. This is done while recognising the increasing risk that their fossil investments might end up as stranded assets, where the pension funds ultimately cannot sell off their investments. At the same time, 64 percent of the Danish pension funds currently have a policy of not expanding activities in coal and oil fields. In 2022, Danish asset managers voted more than 66,000 times at companies’ general meetings, of which every 10th time was against a proposal from the management. The industry was in dialogue with companies more than 5,000 times during 2022, where most were focused on greenhouse gas emissions, governance structures, human and workers’ rights as well as environmental concerns.

Incentivising transition plans for hard-to-abate sectors

The transition requires massive funding in the coming years. At the EU level, the latest projection points to an annual financing need of EUR 620 billion (USD 660 billion) to fulfil the objectives of the Green Deal and RepowerEU. The high financing need reflects, among other things, the imperative to support the conversion of sectors like agriculture and food production, which impact biodiversity. Similarly, materials from some of the heaviest industries – such as cement, steel, and mining – are crucial for the necessary expansion of renewable energy.

It is evident that there is an ongoing need for these industries, but achieving more efficient resource utilisation and a significant reduction of the CO2 footprint from production is essential. Therefore, the global cement industry must reduce its CO2 emissions by up to 90 percent, and the steel industry by up to 100 percent towards 2050, measured in relation to the 2015 level. This reduction is necessary to meet the objectives of the Paris Agreement.

It is crucial to consider the transition comprehensively from the start, ensuring that companies that are heavy emitters but have credible plans for future sustainability also secure financing. This approach promotes existing sustainable technologies and projects, while simultaneously supporting projects and companies in their journey towards sustainability. In this context, active ownership is a central tool for influencing companies toward a more sustainable direction.

CONTRIBUTORS

Glasgow Financial Alliance for Net Zero

Financing the green transition

This article is part of the white paper “Financing the Green Transition”. Discover Denmark’s plans to mobilise investments to accelerate the transition to a carbon-neutral and climate-resilient economy.

Explore the white paper