Annually, global development aid (ODA) amounts to approximately EUR 190 billion (USD 200 billion) — or one-twentieth of the annual investment needed in developing countries to achieve UN Sustainable Development Goals (SDGs) and honour the Paris Agreement. Current global geopolitical and economic conditions make the road to achieving these goals extremely long. War in Europe, rising inflation and interest rates, pressure on public budgets, and general global macroeconomic uncertainty have meant that countries, institutions, and private investors leading the green transition now find themselves forced to prioritise differently to a few years previously.

We must look at development and climate finance with new eyes and shift gears. It is impossible to meet global climate goals without private actors pulling in the same direction, since private investment funds manage sums far greater than global development aid. Therefore, unlocking private investments is imperative to bridging the gap. In Denmark, public-private collaboration is central to tackling climate change and investment mobilisation. This has played out in several ways.

Investment partnership between state and pension funds

The Danish development finance institution, the Investment Fund for Developing Countries (IFU), plays a crucial role in paving the way for private investments. In an investment partnership between the Danish state and Danish pension funds, IFU raised EUR 665 million (USD 700 million) in the

Danish SDG Investment Fund in 2018. The fund is now fully invested and has mobilised investments for a total of EUR 1.9 billion (USD 2.1 billion) across 25 companies in Africa, Asia, and Latin America. This has enabled the installation of close to 1.4 GW of renewable energy, and around 5 GW once

all projects are fully implemented. This will contribute to an avoidance of 6 million TCO2 annually.

Heading towards 2030, the Danish government has decided to increase IFU’s capital base by over EUR 1.8 billion (USD 2 billion). IFU will use this to expand its partnership with institutional investors, and boost its contribution to Denmark’s climate finance, moving from EUR 285 million (USD 300

million) today to around EUR 850 million (USD 900 million) towards 2030.

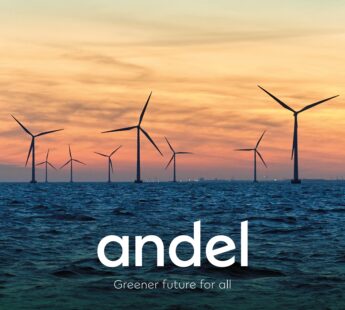

The Export and Investment Fund of Denmark (EIFO)

EIFO is another financing institution under the Danish state, which contributes to accelerate global green transition. EIFO provides risk-tolerant government capital for Danish companies and their foreign and domestic business partners. This lowers some of the risks associated with large investments in green infrastructure both domestically and internationally. Recently, EIFO financed one of the world’s largest wind farms in the Baltic Sea, contributing to a shift from coal to green energy sources.