News

Industry

Photovoltaics

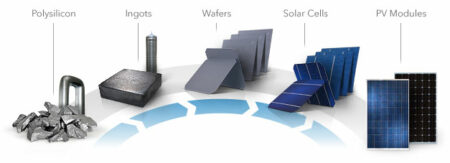

The Current PV Global Supply Chain

In 12 years, the PV cells global manufacturing capacity jumped from almost 25 GW (2010) to more than 220 GW (2022), with China currently weighing up 97% of this production. In addition, another 300 GW of manufacturing capabilities and infrastructures have already been announced, underlying the willingness to prevent other actors from gaining significant shares of the market.

The Chinese market share dominance reflects the ability of local companies to gain benefit from the economies of scale, also thanks to the governmental support to the industry, which has set strategic long-term goals in the industry. In terms of international shipments of PV modules, around half of the total Chinese production has been delivered between 2017 and 2021 to Asia-Pacific regions and India, while the other half went to Europe, with smaller amounts directed to Latin America and the rest of the world.

Where does the energy to manufacture PV come from?

Crystalline silicon production requires a lot of energy, counting almost 0.2% of the global industrial energy use, around 3.4 times the total equivalent electricity consumption of Denmark. The energy-intensive process involves the metallurgical melting of silica at very high temperatures (1700 C), and ingot and wafer electricity-based manufacturing, which also requires high temperatures continuously for hundreds of hours.

Above 80% of the total energy required is in the form of electricity consumption, although, despite the fact that global coal share in the world electricity consumption is around 36%, the global solar PV production accounts for 62%, followed by renewables, gas, and nuclear energy, with 87% of global related emissions coming from Chinese-based production sites.

Nevertheless, as the last report on the solar PV supply chain from the International Energy Agency tells, the speed with which the CO2 manufacturing credits are recovered by the operations of solar plants is very high in most countries: between 2 and 6 months to recover the manufacturing carbon credit with domestically-produced solar modules.

How many jobs does PV manufacturing actually create?

According to the IEA, more than half of the jobs in the whole renewable manufacturing industry come from the PV sector. Similarly to production trends, China reached 85% of the global PV manufacturing-related jobs in 2021 (around 450.000), with modules and cells manufacturing sectors leading in job creation capacity, followed by wafers and polysilicon. Estimates from the agency tell that each GW of PV capacity could create up to 1300 manufacturing jobs in the industry.

Which are the vulnerabilities of the PV supply chain in the long run?

Crucial vulnerabilities related to the current scenario might fall under:

- geographical concentration, due to natural risks and extreme weather,

- market concentration, due to the risk of market power and manipulation,

- scalability issues, due to the critical mining requirements to keep up with the demand,

- and financial risk, exacerbated by volatile prices and/or policy changes.

Reaching Net-zero climate goals will require a huge deployment of PV, creating possible bottlenecks from the mineral requirements to the low-cost electricity required for modules production, as well as key challenges in end-of-life treatments and recycling.

Government policies will be crucial to giving birth to a more stable and secure PV supply chain.

You can download the recent IEA report here.

Follow us for many more news and insights!

Green Dealflow is an exclusive matchmaker for professional investors and project developers in the solar and wind industry. For developers, we provide the service of introducing the relevant investors or PPA off-takers for their projects within 2-4 weeks (off-market with discretion). Other services we provide to the developers are secure data room service, financial modelling service, running a structured process to sell projects etc. For investors, we provide the project based on their investment criteria and run an RPF process to source projects in any market as a mandate holder. Further to this, we deliver renewable news and trends, blog posts and business intelligence, e.g. through transaction reviews etc., to our client base periodically. Remember to register your interest with us.

You should consider reading

Perspective

Sector coupling

+9

New white paper: Unlocking the potential of renewable energy through sector coupling

23 October 2024solutions

Combined heat and power production

+6

CopenHill: The story of the iconic waste-to-energy plant

20 November 2024solutions

Energy efficiency in buildings

+2